Global Education Communities Corp. Reports 2023 Third Quarter Financial Results

Vancouver, B.C., July 17, 2023 – Global Education Communities Corp. (“GECC” or the “Company”) (TSX: GEC, OTCQX International: GECSF) is pleased to report that it has filed on SEDAR its consolidated financial statements (“Q3 2023 Financial Statements”) and related management’s discussion and analysis (“MD&A”) for its third quarter of fiscal 2023 ended May 31, 2023 (collectively, the “Q3 Filing“). The following is selected financial information for the nine months ended May 31, 2023 (“YTD 2023“) and comparative results (“YTD 2022”). Please refer to the Q3 Filing in its entirety, which is available under the Company’s profile at www.sedar.com.

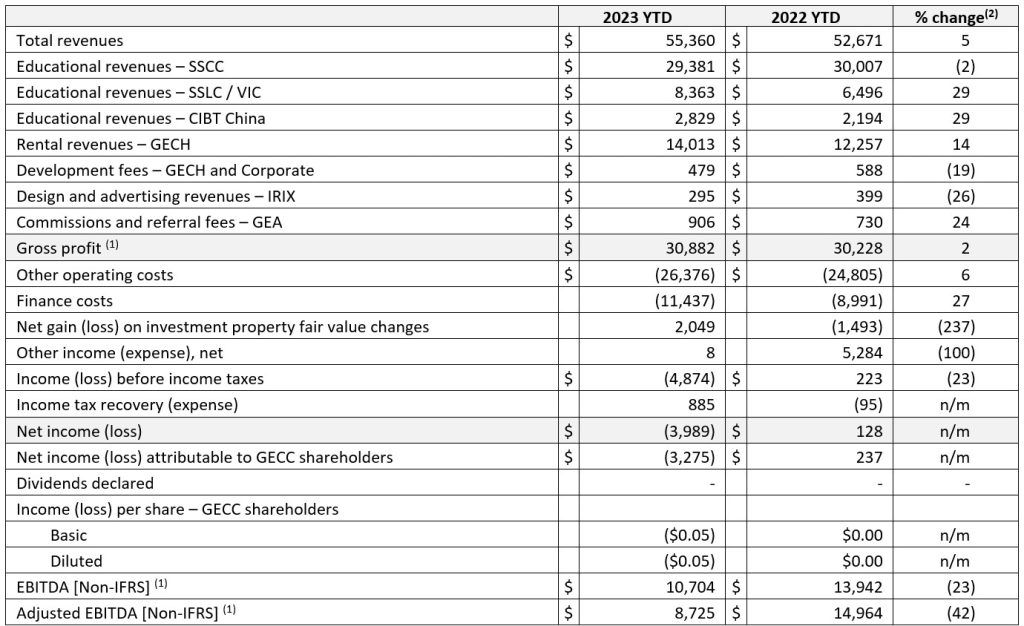

The following table presents selected financial data from the Q3 Filing with comparisons. All figures are in thousands of Canadian dollars, except share and per share data, unless otherwise noted.

(1) Non-IFRS specified financial measure. See “Non-IFRS Financial Measures” at the end of this news release for more information on each non-IFRS specified financial measure. Gross margins reflected in the table above and referenced in the MD&A below as “Margins,” are defined in the section “Non-IFRS Financial Measures” on page 15 of the MD&A.

(2) Percentage change amounts reflect the relative change in the individual balance with the impact (negative or positive) on net income.

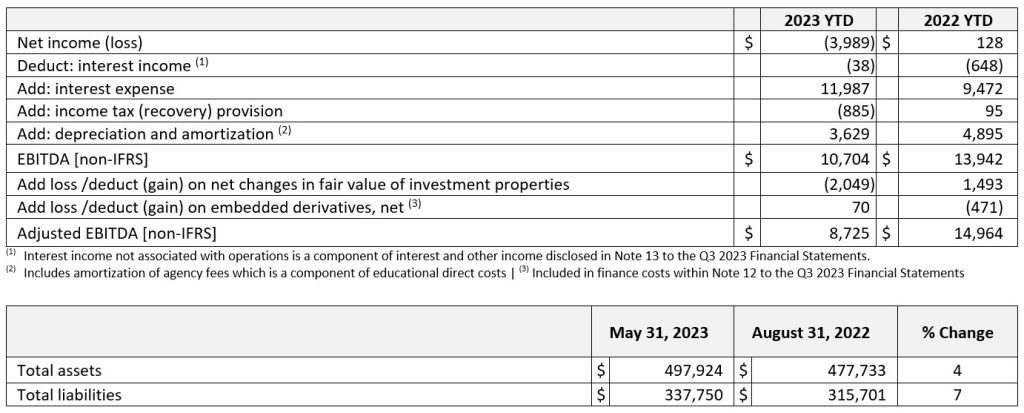

The following table reconciles non-IFRS measures to the most directly comparable IFRS measure disclosed in the Q3 2023 Financial Statements, which is net income (loss).

“We are pleased to report that our total year-to-date 2023 revenue as of May 31, 2023 has increased by 5% to $55.36 million as compared to the same period last year,” said Toby Chu, Chairman, President and Chief Executive Officer of the Company. “The year-to-date 2023 revenue of our international education services divisions in Canada and abroad saw substantial increases year-over-year of 29%. Correspondingly, our student-housing revenue also saw significant growth. Most GEC®-branded residential properties are fully booked, while rental rates per square foot reached the highest levels. As a result, the Company’s student-housing rental revenue for the nine months grew by 14% to $14.013 million compared to $12.257 million over the same period last year. Our year-to-date 2023 EBITDA (Earnings before Interest, Taxes, Depreciation Amortization)as of May 31, 2023 reached $10.704 million, and our total assets increased by 4% to nearly $500 million.

“Between March 3, 2022, and July 12, 2023, the Bank of Canada prime rate has increased 167%, from 2.7% to 7.2%*a, which has impacted the financial and credit markets and increased the finance costs of our real estate services division,” continued Toby. “To offset the additional financing costs, our student-housing division has adjusted its rental rates several times this year, which led to a $1.76 million increase in our rental revenue despite the Company not adding new operating properties during YTD 2023.”

Toby added, “Furthermore, our international educational revenue continues to increase year-over-year, including our student recruitment revenue, which increased substantially by 26%, highlighting a solid trajectory of growth for the international education sector and boosting our student-housing revenue simultaneously. Our real estate division, GEC Living (www.GECliving.com), rolled out its 8th GEC®-branded property, GEC® King Edward, on June 1, 2023. Students have started moving into this property, and we reached an occupancy rate of 75% by mid-July. The property is fully booked as of September 2023 for the upcoming academic year.

“Early this year, the IRCC (Immigration Canada) reported the international student population in Canada reached a new record of 807,750 students as of December 2022, an increase of 30% from 617,000 students in the previous year*b, elevating Canada to the top three positions in the world with the highest number of international students.

“According to a news article*c referencing the July 2023 liv.rent report*d, West Vancouver, North Vancouver, Vancouver, Richmond, and Burnaby have been ranked as Canada’s top five most expensive cities. The article also highlighted the increase in demand for rental housing and the target overnight rate hike, which could lead to a significant rise in average rental rates in British Columbia.

“Consistent with the article’s view, we believe the interest rate hike has a cascading effect on the rental market because high-interest rates discourage home buyers from entering the market, which slows down rental project developments, and depletes the available inventory in the development pipeline, causing a significant shortage in the rental inventory. As the demands continue, prompted by migrations to Metro Vancouver, new immigrants arriving in Canada, and the high volume of international students entering Canada, the diminishing rental supply will inevitably push rental rates to unprecedented levels.”

About GECC:

GECC is one of Canada’s largest education and student housing investment companies focused on the domestic and global education market since 1994. GECC owns business and language colleges, student-centric rental apartments, recruitment centres and corporate offices at 41 locations in Canada and abroad. Its education subsidiaries include Sprott Shaw College Corp. (“SSCC”) (established in 1903), Sprott Shaw Language College (“SSLC”), Vancouver International College Career Campus (“VIC”) and CIBT School of Business & Technology Corp. (“CIBT China”). GECC offers over 150 educational programs in healthcare, business management, e-commerce, cyber-security, hotel management, and language training through these schools. In 2022, GECC serviced over 13,000 domestic and international students through its educational, rental housing and recruitment subsidiaries.

GECC owns Global Education City Holdings Inc. (“GECH”), an investment holding and development company focused on education-related real estate such as student-centric rental apartments, a hotel and education super-centres. Under the GEC® brand, GECH provides accommodation services to 92 schools in Metro Vancouver, serving 3,000 students from 71 countries. The total portfolio and development budget under the GEC® brand is nearly $1.3 billion.

GECC also owns Global Education Alliance Inc. (“GEA”) and Irix Design Group Inc. (“IRIX”). GEA recruits international students for elite kindergartens, primary and secondary schools, colleges and universities in North America. Irix Design is a leading design and advertising company based in Vancouver, Canada. Visit us online and watch our corporate video at www.GEChq.com.

For more information, contact:

Toby Chu

Chairman, President & CEO

Global Education Communities Corp.

Investor Relations Contact: 1-604-871-9909 extension 319 or | Email: info@GEChq.com

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information (the “forward-looking statements“) about GECC and its plans. Forward-looking statements are statements that are not historical facts. Forward-looking statements in this news release include, without limitation, that rental rates will continue to rise. The forward-looking statements are subject to various risks, uncertainties and other factors (collectively, the “Risks”) that could cause the Company’s actual results or achievements to differ materially from those expressed in or implied by forward-looking statements. The Risks include, without limitation, national and global economic factors, customary risks of the construction industry, unexpected delays or requirements of the applicable municipalities, and the other risk factors identified in the MD&A forming part of the Q3 Filing. Forward-looking statements are based on the beliefs, opinions and expectations of the Company’s management at the time they are made, and the Company does not assume any obligation to update its forward-looking statements if those beliefs, opinions or expectations, or other circumstances should change, except as may be required by law.

NON-IFRS FINANCIAL MEASURES

The Company has included certain non-IFRS financial measures throughout this document including: (a) Earnings before Interest, Taxes, Depreciation and Amortization (“EBITDA”); (b) Adjusted EBITDA which is EBITDA adjusted for the gain (loss) on change in fair value of the Company’s investment properties and the gain (loss) on change in fair value of derivative instruments, provision for expected credit losses on development and other assets, impairment of development assets, and net gain or loss recognized on fair value changes in embedded derivatives associated with certain financial liabilities; and (c) Gross Profit (“Gross Profit”) which is the difference between revenue and direct costs of sales. These non-IFRS financial measurements do not have any standardized meaning as prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. Accordingly, these performance measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Management uses EBITDA and Adjusted EBITDA metrics to measure the profit trends of the business units and segments in the consolidated group since it eliminates the effects of financing decisions. Management uses Gross Profit to assess how efficiently the Company generates profit from the sale of goods or services. Certain investors, analysts and others utilize these non-IFRS financial metrics in assessing the Company’s financial performance. These non-IFRS financial measurements have not been presented as an alternative to net income (loss) or any other financial measure of performance prescribed by IFRS. Reconciliation of the non-IFRS measures have been provided throughout the Company’s MD&A, as applicable, filed under the Company’s profile on www.SEDAR.com.

*a https://wowa.ca/banks/prime-rates-canada

*b https://monitor.icef.com/2023/02/canadas-foreign-enrolment-grew-by-more-than-30-in-2022/

*c https://dailyhive.com/vancouver/rental-price-gap-between-vancouver-canadian-cities-growing

*d https://liv.rent/blog/rent-reports/july-2023-metro-vancouver-rent-report/